4 Minutės

Bitcoin ETF outflows accelerate over Christmas trading

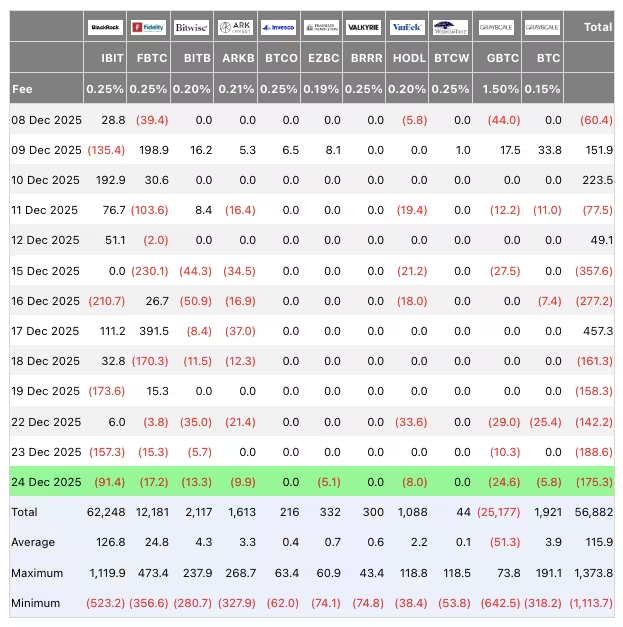

Spot Bitcoin exchange-traded funds (ETFs) recorded substantial net outflows through the final U.S. pre-Christmas trading sessions, shedding institutional capital just as holiday season liquidity thinned. Data compiled by Farside Investors show U.S. spot Bitcoin ETF netflows were negative on Christmas Eve, with an estimated $175.3 million leaving the market during the last trading day before the holiday.

That single-day figure capped a five-day run of red days for institutional flows, totaling roughly $825.7 million in net outflows. Since Dec. 15 the ETF market has only seen one positive trading day — Dec. 17, which drew $457.3 million in inflows.

US spot Bitcoin ETF netflows (screenshot)

Why institutions are selling: tax-loss harvesting and options expiry

Market participants point to seasonality and tax strategies as primary drivers behind the recent selling pressure. Many institutional investors and funds engage in tax-loss harvesting toward year-end, crystallizing losses to offset taxable gains elsewhere. That corporate and institutional rebalancing often causes concentrated outflows during December.

Additionally, the quarter-end options expiry — a sizable derivatives event — likely reduced risk appetite into the close. Traders said the combined effect of tax-driven selling plus record options expiry pushed institutions to step back and trim exposure temporarily.

Coinbase Premium Index

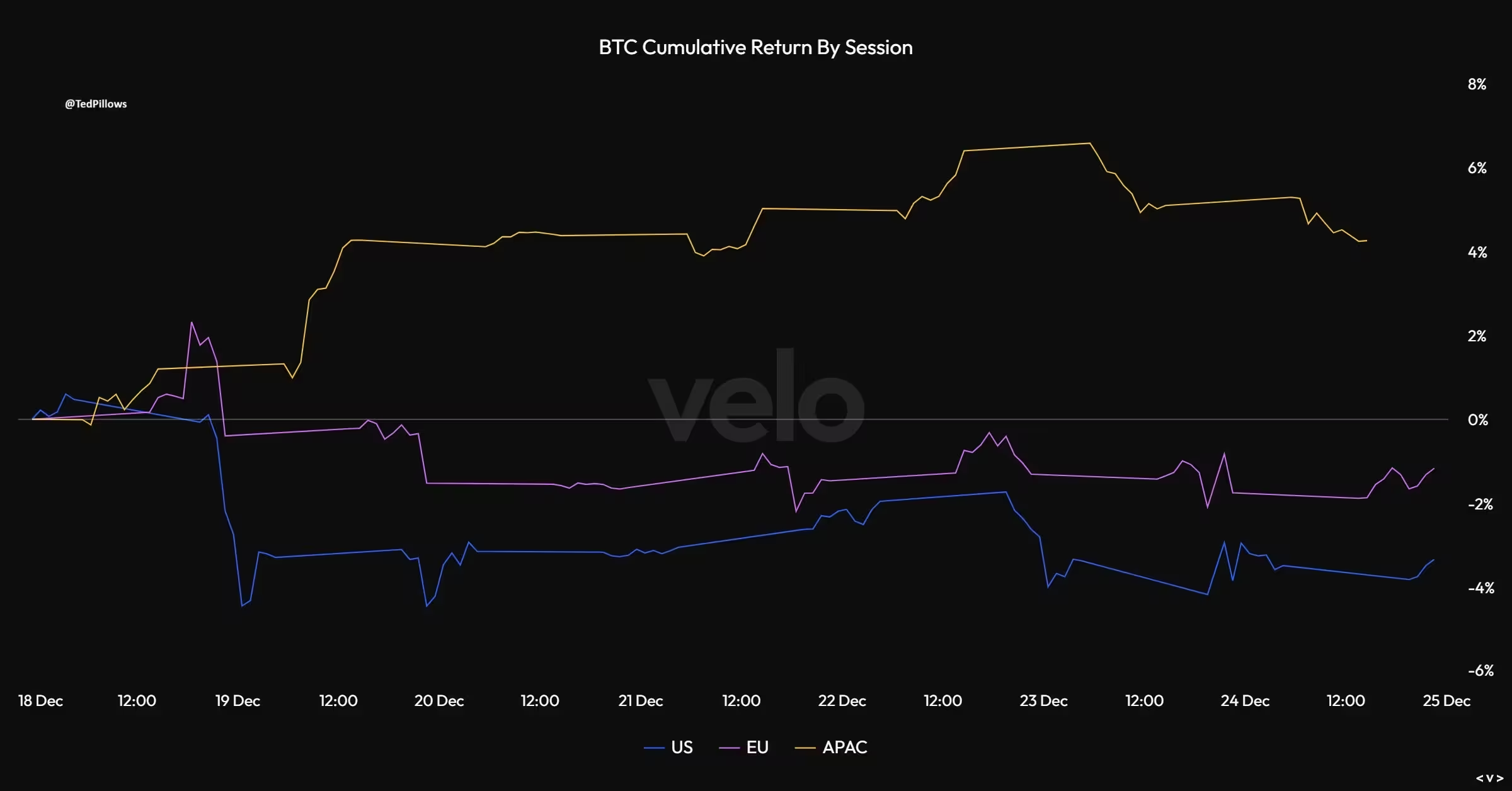

Geographic flow dynamics: US sellers, Asia buyers

On-chain and exchange-based indicators have underscored a striking regional split: U.S. liquidity has been a net seller of Bitcoin while Asian demand has absorbed supply. The Coinbase Premium — which tracks the price gap between Coinbase BTC/USD and Binance BTC/USDT — has remained mostly negative through much of December. A persistent negative premium typically signals weaker buyer demand from U.S. fiat-based venues and can make it harder for prices to sustain higher levels.

Crypto analyst commentary echoed this view: with U.S. buying subdued and Asian markets stepping in, the short-term price action reflects a tactical redistribution of Bitcoin allocation across regions rather than a structural destruction of demand.

BTC/USD cumulative returns by session

Outlook: liquidity inactive, not gone

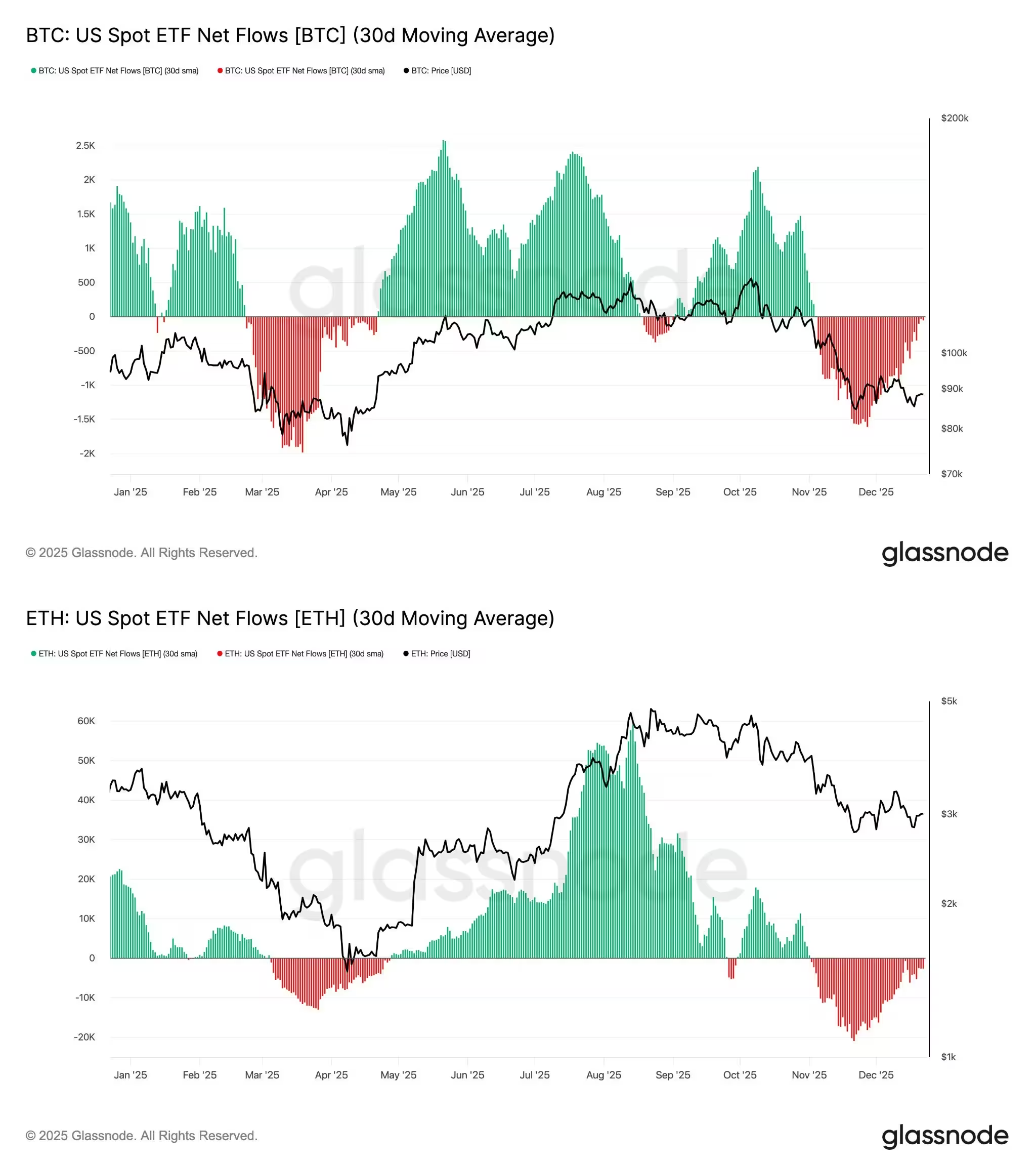

Despite the near-term drain, traders and analysts expect the institutional bid could return after holiday-related selling subsides. Some market voices argue negative ETF netflows — even when persistent on a 30-day moving average — are not definitive signs of a market top. Instead, they view the current environment as one of dormant liquidity, where flows need to stabilize and flip neutral before fresh inflows resume.

"Price usually stabilizes first, flows turn neutral, then inflows return," noted one trader, summarizing the typical sequence that precedes durable rallies in ETF-led markets. For both Bitcoin and Ether spot ETF products, the 30-day moving average of netflows has been negative since early November, reinforcing the narrative that liquidity is simply inactive rather than destroyed.

Spot Bitcoin, Ether ETF netflows 30-day moving average

What traders are watching next

Key gauges to monitor in the coming sessions include: the Coinbase Premium reverting to positive, which would indicate U.S. buyer re-engagement; a normalization of post-expiry positioning; and the end of tax-loss harvesting flows after year-end. If these conditions align, analysts expect ETF inflows to return and provide a more constructive backdrop for BTC and related crypto markets.

For traders and investors, the immediate takeaway is to separate mechanical, seasonal selling from longer-term demand trends. Institutional selling around tax deadlines and options expiries is familiar behavior — history suggests these events can temporarily amplify outflows but do not necessarily signal a permanent reversal in institutional appetite.

Šaltinis: cointelegraph

Palikite komentarą